At Go Digit General Insurance Co Ltd, we understand the significance of good health and its impact on your quality of life. Introducing the Digit Arogya Sanjeevani Policy, a comprehensive health insurance plan designed to offer you and your family the protection and peace of mind you deserve. With a wide range of benefits and flexible options, our policy ensures that you are well-prepared to face any healthcare challenges that may arise.

Our policy offers competitive and affordable premium rates, making it accessible for everyone to invest in their health without straining their finances.

Enjoy extensive coverage for hospitalization expenses, pre and post-hospitalization expenses, daycare treatments, Ayush treatments, ambulance charges, and more.

Benefit from hassle-free cashless treatment at our extensive network of hospitals and healthcare providers across the country. Say goodbye to upfront payments and reimbursement hassles.

Choose from a variety of sum insured options to suit your healthcare needs and budget. Whether you're looking for basic coverage or comprehensive protection, we have you covered.

Rest easy knowing that your policy can be renewed for a lifetime, ensuring continuous coverage and peace of mind for you and your loved ones.

Enjoy the freedom to choose hospital rooms without any restrictions on room rent, allowing you to focus on your recovery without worrying.

Avail tax benefits under Section 80D of the Income Tax Act, making it a smart financial investment for your future.

Invest in your health and secure your financial future with the Digit Arogya Sanjeevani Policy from Go Digit General Insurance Co Ltd. Contact us today to learn more about our policy features, premium rates, and enrollment process. Our dedicated team of insurance experts is here to guide you through every step of the way and help you find the right coverage that meets your needs.

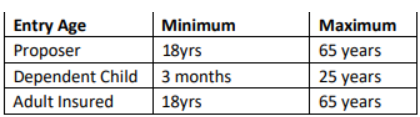

Below is the Minimum & Maximum Entry age for Adults & Children:

Family consists of the proposer and any one or more of the family members as mentioned below:

1.legally wedded spouse.

You can opt for a minimum Sum Insured of INR 1 lakh and maximum up to INR 5 lakhs in the multiples of INR 50,000.

What benefits are available if I transfer(renew) my policy from some other insurer to this Policy? Portability and Continuity Benefits are as mentioned below:

We will grant continuity of benefits which were available to the Insured Members under a health insurance policy which provides same coverage in the immediately preceding Cover Year provided that:

i. We shall be liable to provide continuity of only those benefits (for e.g.:

Initial wait period, wait period of Specific Diseases pre-existing disease etc) which are applicable under this Policy.

ii. Any other wait period that is applicable specific to this policy but was permanently excluded in the previous policy will not be given any credit.

iii. Insured Members covered under this Policy shall have the right to migrate from this Policy to an individual health insurance policy or a family floater policy offered by our company. The credit for wait periods would be given in the opted individual health insurance policy or a family floater policy offered by our company. Application for this Policy is made within 45 days before, but not earlier than 60 days from the expiry of that insurance policy.