ICICI Pru Guaranteed Income for Tomorrow (GIFT) is a popular savings and protection-oriented life insurance plan offered by ICICI Prudential Life Insurance Company. This plan is designed to provide financial security and guaranteed income to policyholders and their families.

Steady Cash Flow: ICICI Pru GIFT provides a guaranteed regular income to the policyholder for a specified period. This steady cash flow can be used to meet daily expenses.

Death Benefit: In the unfortunate event of the policyholder's demise during the policy term, a death benefit is payable to the nominee, providing financial security to the family.

Convenience: ICICI Pru GIFT offers various premium payment options such as single pay, limited pay (5 or 7 years), or regular pay, allowing.

Enhanced Maturity Value: The plan provides guaranteed additions at the end of each policy year, which are added to the policy account and enhance the overall maturity value of the policy, helping policyholders build a substantial corpus over time.

Tax Savings: Premiums paid towards ICICI Pru GIFT are eligible for tax benefits under Section 80C of the Income Tax Act, 1961. Additionally, the death benefit and maturity benefit received under the policy are tax-free under Section 10(10D) of the Income.

Reputed Insurer: ICICI Prudential Life Insurance Company is one of the leading and most trusted life insurance companies in India, known for its strong financial stability, excellent customer service, and efficient claim settlement process.

Tailored Solutions: The plan offers flexibility in choosing the policy term, payout frequency, and premium payment term, allowing policyholders to customize the plan according to their financial goals, retirement planning, and risk appetite.

Dual Benefits: ICICI Pru GIFT combines the benefits of savings and protection, helping policyholders build a corpus for future financial needs while providing life cover to protect their family's financial future, making it a comprehensive solution.

Upon survival till the end of the policy term, the policyholder receives the guaranteed maturity benefit, which includes the guaranteed sum assured and any accumulated guaranteed additions, ensuring financial stability in the long run.

| Description | Minimum | Maximum |

|---|---|---|

| Age at entry | 3 years | 60 years |

| Minimum Premium | 1,00,000. + GST | |

| Max Premium | Multiples of 10000 | |

| Premium Paying Term | 12 years | |

| Policy Term | 15 years/20 years | |

| Death Benefit | 10 times of Annual Base premium | |

Under this plan option, you can choose to pay premiums for 6, 7, 8, 10 or 12 years (PPT) and you will receive regular income from 2nd year onwards.

Your policy term is PPT+1 and the life cover is available for the entire policy term.

The income that you receive from 2nd year onwards till the end of the policy term is known as Guaranteed Early Income. The income that you receive after the policy term is known as Guaranteed Income.

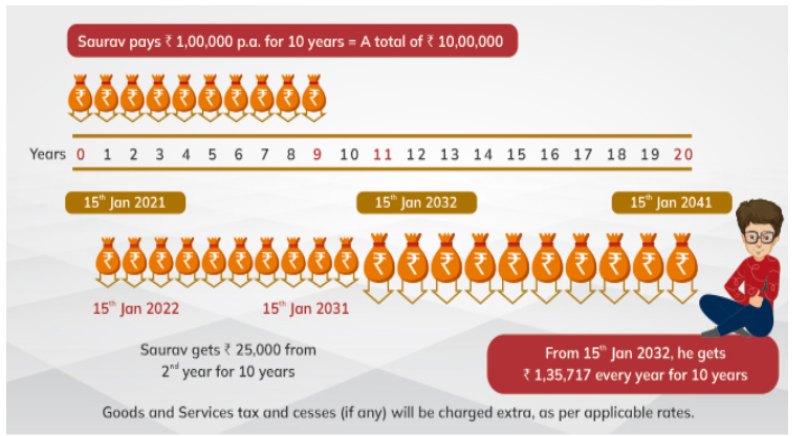

Saurav is a 35 year old male, paying an annual premium of `1 lakh in ICICI Pru Guaranteed Income For Tomorrow. He wants to create an alternate source of income for himself so that he can plan to retire early. Moreover, he wants some income to start off from the very next year to take care of his son’s school fees.

The table below shows the regular income that Saurav will receive, for different combinations of premium payment term and policy term.

Saurav also has the flexibility to receive the Guaranteed Income either every year or every month during the Income Period.

Guaranteed Income on an annual basis for a premium payment term of 10 years is `1,35,717.

If he chooses to receive this income every month, the amount will be `1,39,789 for the whole year i.e. he will receive `1,39,789/12 = `11,649 every month for 10 years.

In case of an emergency that comes his way at the time of maturity or during the Income Period, Saurav also has an option to take all future Guaranteed Income as a one-time lump sum.

If the person whose life is covered by this policy (known as the Life Assured) passes away, during the term of the policy, the insurance cover amount will be paid out as a lump sum to the person specified (known as the Claimant) in the policy.

Life Insurance Benefit is highest of:

a. Sum Assured on Death

b. 105% of Total Premiums Paid up to the date of death

c. Annual Guaranteed Income X Death Benefit factor for Early Income plan option, where,

Sum Assured on Death is 10 X Annualised Premium

In case of death of the Life Assured during the Income Period, the Claimant will continue to receive the income. The Claimant shall have an option to receive the future income as a lump sum.