LIC Jeevan Labh is a popular non-linked, limited premium paying endowment plan offered by the Life Insurance Corporation of India (LIC). It is designed to provide financial protection and savings benefits to policyholders along with the opportunity to earn bonuses and participate in the profits of LIC.

Convenience: LIC Jeevan Labh offers a limited premium payment term of 10, 15, or 16 years, allowing policyholders to pay premiums for a shorter duration while enjoying the benefits of the plan for a longer period.

Financial Discipline: The limited premium payment term encourages financial discipline and ensures that you remain committed to the plan by paying premiums for a defined period.

Financial Security: LIC Jeevan Labh provides financial protection to your family by offering a death benefit to the nominee in case of the policyholder's demise during the policy term. Wealth Creation: The plan offers a maturity benefit on survival till the end of the policy term, including the sum assured, accrued bonuses, and final additional bonus, if any, providing an opportunity to create wealth over time.

Guaranteed Additions: LIC Jeevan Labh offers guaranteed additions at the rate of Rs. 50 per thousand sum assured for the first five years of the policy, enhancing the overall maturity value. Participation in Profits: Policyholders participate in the profits of LIC and are eligible to receive simple reversionary bonuses declared annually, along with a final additional bonus at the time of maturity or death, ensuring better returns on investment.

Customization: Choose the policy term of 16, 21, or 25 years based on your financial goals and retirement planning needs. Enhanced Coverage: Opt for additional riders such as accidental death benefit rider and disability benefit rider by paying an extra premium to enhance specific risks and contingencies.

Tax Savings: Premiums paid towards LIC Jeevan Labh are eligible for tax benefits under Section 80C of the Income Tax Act, 1961. Additionally, the death benefit and maturity benefit received under the policy are tax-free under Section 10(10D) of the Income Tax Act, making it a tax-efficient investment option.

Reputation: LIC is a government-owned insurance and investment corporation with a strong legacy of over six decades, known for its reliability, financial stability, and efficient claim settlement process.

Transparency: LIC Jeevan Labh is a transparent plan with clearly defined terms and conditions.

Policy Purchase:

• Application Process: Submit a duly filled application form along with the required documents such as identity proof, address proof, age proof, and income proof to purchase LIC Jeevan Labh.

• Medical Examination: Undergo a medical examination if required by LIC based on the age and sum assured of the policyholder.

Choosing the Premium Payment Term:

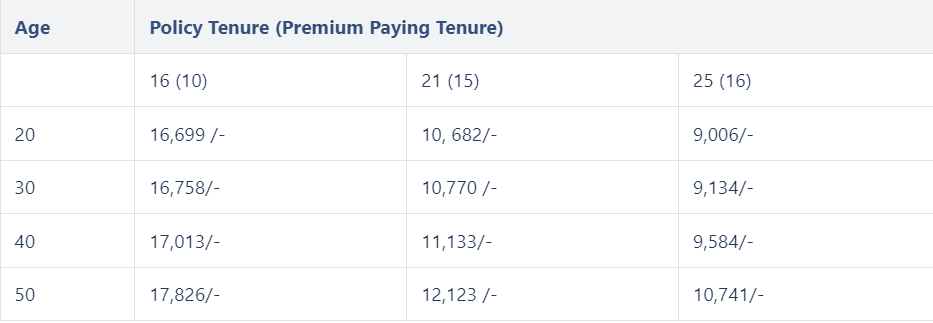

• Limited Premium Payment: Select a limited premium payment term of 10, 15, or 16 years, while the policy term is fixed at 16, 21, or 25 years respectively.

• Premium Amount: Calculate the premium amount based on the chosen sum assured, premium payment term, age, and other factors. Pay the premiums at regular intervals (monthly, quarterly, half-yearly, or yearly) as per the selected mode.

Accumulation of Bonuses:

• Guaranteed Additions: LIC Jeevan Labh offers guaranteed additions at the rate of Rs. 50 per thousand sum assured for the first five years of the policy.

Simple Reversionary Bonuses: Policyholders participate in the profits of LIC and are eligible to receive simple reversionary bonuses, which are declared annually and accrue to the policyholder's account.

• Final Additional Bonus: An additional one-time bonus may be declared at the time of maturity or death, providing an extra layer of returns on the investment.

Insurance Coverage:

• Death Benefit: In the event of the policyholder's demise during the policy term, the death benefit is payable to the nominee.

• Coverage Amount: The death benefit includes the higher of the sum assured on death or 10 times the annualized premium, along with vested simple reversionary bonuses and final additional bonus, if any.

• Maturity Benefit: If the policyholder survives the policy term, the maturity benefit is paid out, which includes the sum assured on maturity along with vested simple reversionary bonuses and final additional bonus, if any.

Optional Riders for Enhanced Coverage:

• Accidental Death Benefit Rider: Policyholders can opt for an accidental death benefit rider by paying an additional premium, which provides an additional sum assured in case of death due to an accident.

• Disability Benefit Rider: Policyholders can opt for a disability benefit rider by paying an extra premium, which waives off future premiums in case of permanent disability due to an accident.

Tax Benefits:

• Tax Savings: Premiums paid towards LIC Jeevan Labh are eligible for tax benefits under Section 80C of the Income Tax Act, 1961. Additionally, the death benefit and maturity benefit received under the policy are tax-free under Section 10(10D) of the Income Tax Act, making it a tax-efficient investment option.

Loan Facility and Surrender:

• Loan: After the completion of the premium payment term, policyholders can avail a loan against the policy's surrender value, providing liquidity and financial flexibility.

Surrender: Policyholders have the option to surrender the policy after the completion of the premium payment term and before the maturity to receive the surrender value, subject to applicable charges and conditions.

| Description | Minimum | Maximum |

|---|---|---|

| Age at entry | 8 years | 59 years |

| Premium |

Based on Sum Insured (minimum SI 3 lacs) |

No Limit |

| Premium Payment Term | 10 years | |

| Policy Term | 16 years | |

| Death Benefit | SA – 3,00,000 to 4,99,500 (increases as per term) | |

| Inbuilt Rider |

Accidental Death & Disability Benefit Rider |

|

Let’s understand this with the help of an example.

Say that Ravi (30 years old) wants to purchase the LIC 936 policy with the following coverage options -

1.Basic Sum Assured (BSA) – Rs.10 Lakhs

2.Policy Term - 21 years

3.Premium Paying Term - 15 years

Using the LIC Jeevan Labh Calculator, the annual premium comes to be Rs.54,707.

Death benefit to the family if Ravi dies in the 10th year of the policy

• Higher of (7 x 54,707 = Rs.3.82 Lakhs) or the BSA (Rs.10 lakhs), which means the nominee will receive the latter.

• Over 10 years, the bonus will be equal to Rs (44 x 10,00,000/1,000) x 10 = Rs. 4.4 Lakhs.

• The total death benefit will be equal to Rs (10,00,000 + 4,40,000) = Rs. 14,40,000.

• He will get the BSA (Rs.10 lakhs) plus accrued bonuses.

• The total bonus amount for 21 years will be equal to Rs (44 x 10,00,000/1,000) x 21 = Rs.9.24 Lakhs.

• The final maturity value at the end of 21 years will be equal to Rs.19.24 lakhs.