Critical Illness is a specialized insurance product designed to provide financial protection in the event of a serious illness diagnosis. Developed by Bajaj Allianz General Insurance Co Ltd, a trusted name in the insurance industry, Critical Illness offers comprehensive coverage and peace of mind during challenging times.

Critical Illness provides you with peace of mind knowing that you're financially protected in the event of a serious illness diagnosis. With coverage for a wide range of critical illnesses, you can rest assured that you and your loved ones will have the support you need during challenging times.

A diagnosis of a critical illness can have a significant financial impact, with medical expenses, treatment costs, and other expenses adding up quickly. Critical Illness offers financial security by providing a lump sum payment upon diagnosis, helping you cover these expenses and maintain.

Bajaj Allianz General Insurance Co Ltd is committed to providing you with high-quality service and support throughout your insurance journey. Our dedicated team is here to help you understand your coverage options, file claims, and navigate the claims process with ease.

Get Started with Critical Illness

Protect yourself and your loved ones from the financial impact of serious illnesses with Critical Illness by Bajaj Allianz General Insurance Co Ltd. Contact us today to learn more about Critical Illness and how it can provide you with the peace of mind and financial security you deserve. With Critical Illness, you can focus on your health knowing that you're prepared for whatever the future may hold.

1 Year / 2 Year / 3 Year

Discount under the policy:

Long Term Policy Discount: a. 4 % discount is applicable if policy is opted for 2 years b. 8 % discount is applicable if policy is opted for 3 years

*Note: This will not apply to policies where premium is paid in installments

What is the premium paying term?

Policy can be paid on installment basis-Annual, Half Yearly, Quarterly or Monthly

What are the Sum Insured options available?

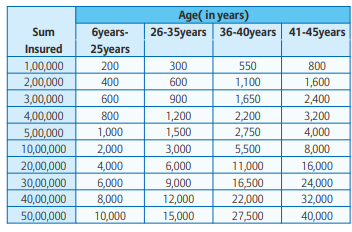

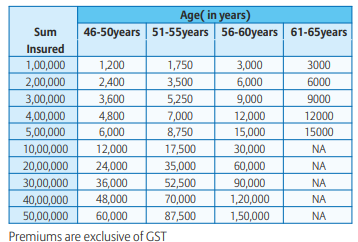

• Sum Insured options of `100000/- to `5000000/- for age group 6 years to 60 years

• Sum Insured options of `100000/- to `500000/- for age group 61 years to 65 years

What are the exclusions under the policy?