Premium Personal Guard is a comprehensive insurance plan designed to provide financial protection and peace of mind to individuals and their families. Developed by Bajaj Allianz General Insurance Co Ltd, a trusted name in the insurance industry, Premium Personal Guard offers a wide range of benefits to safeguard you against life's uncertainties.

Premium Personal Guard offers comprehensive coverage against accidental death and disability, providing you with financial security and peace of mind in the face.

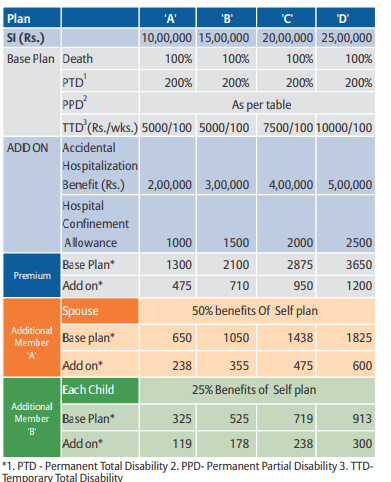

With competitive premiums and flexible coverage options, Premium Personal Guard is an affordable way to protect yourself and your loved ones from the financial impact of accidents.

Applying for Premium Personal Guard is quick and easy, with no medical check-ups required. Simply fill out the online application form and receive instant coverage.

Bajaj Allianz General Insurance Co Ltd is committed to providing you with high-quality service and support throughout your insurance journey. Our dedicated team is here to help you understand your coverage options, file claims, and navigate the claims process with ease.

Get Started with Premium Personal Guard

Protect yourself and your loved ones from the financial consequences of accidents with Premium Personal Guard by Bajaj Allianz General Insurance Co Ltd. Contact us today to learn more about Premium Personal Guard and how it can provide you with the peace of mind and financial security you deserve. With Premium Personal Guard, you can face life's uncertainties with confidence, knowing that you have the protection you need.

Entry age for Proposer and Spouse is 18years to 65 years.

Dependent Children can be covered from 5years to 21years.

This is an annual policy

Self, Spouse and dependent children can be covered under this policy.

maintained without a break.

• Premium payable on renewal and on subsequent continuation of cover are subject to change with prior approval from IRDA.

Call our toll free number or contact any of our agents directly. We will take through our user-friendly procedures, step-by-step. Or visit our website www.bajajallianz.co.in to take our policy.

Free Look Period

Free Look Period

• If you are not satisfied with policy coverage, terms and conditions, You have the option of canceling the policy within 30 days of receipt of the first year policy documents, provided there has been no claim.

• Free look period is not applicable for renewal policies.