Healthcare is an integral part of our lives, and having a comprehensive health insurance plan is vital to ensure that you and your loved ones are protected against unexpected medical expenses. At The New India Assurance Co. Ltd, we are dedicated to providing innovative and affordable healthcare solutions tailored to meet your unique needs. Introducing New India Premier Mediclaim Policy, our premium health insurance plan designed to offer extensive coverage, ensuring enhanced financial security, and providing peace of mind during medical emergencies.

Our Premier Mediclaim Policy offers comprehensive coverage for hospitalization expenses, surgeries, treatments, diagnostic tests, medications, and more, ensuring that you and your family receive the best medical care without financial worries.

Benefit from high sum insured options to provide you and your family with extensive coverage against major medical expenses. Customize your coverage to suit your healthcare needs and budget.

Enjoy hassle-free cashless treatment at our extensive network of hospitals and healthcare providers across the country. Access quality healthcare services without worrying about upfront payments or reimbursement hassles.

Our policy offers no room rent limits, allowing you to choose hospital rooms according to your preference and comfort without any restrictions.

Coverage for daycare treatments and procedures that do not require 24-hour hospitalization, ensuring comprehensive coverage for a wide range of medical conditions.

Our policy covers pre and post-hospitalization expenses, including doctor consultations, diagnostic tests, and medications, ensuring complete care and support during your recovery period.

Coverage for organ donor expenses, including the cost of organ transplantation surgery and post-operative care for the donor, ensuring comprehensive coverage for life-saving procedures.

Reimbursement of ambulance charges in case of emergency hospitalization, ensuring timely access to medical care without any financial burden.

Avail tax benefits on your premium payments under Section 80D of the Income Tax Act, making it a tax-efficient investment for your future.

Invest in your health and secure your financial future with New India Premier Mediclaim Policy by THE NEW INDIA ASSURANCE CO. LTD. Contact us today to learn more about our policy features, premium rates, and enrollment process. Our dedicated team of insurance experts is here to guide you through every step of the way and help you find the right coverage that meets your healthcare needs.

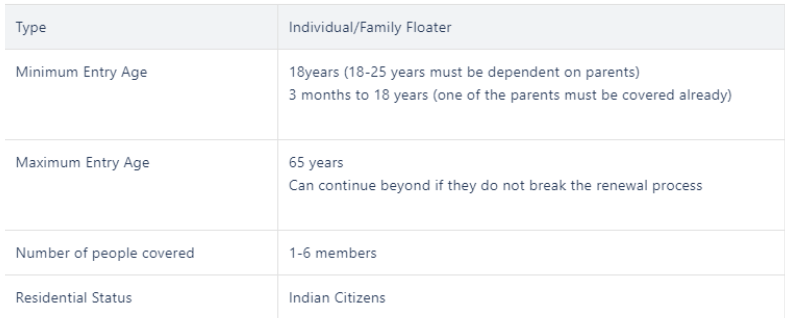

New India Premier Mediclaim Policy is a comprehensive health insurance offered under New India Assurance Health insurance. This policy can be availed as individual and family floater basis. The policy covers the insured for unforeseen hospital expenses, in-patient expenses including intensive care units and other critical care benefits to provide the insured with complete medical protection.

The minimum eligibility criteria to buy this policy are:

Out of the many benefits and features of the New India Premier Mediclaim Policy, Some of them are listed below:

• All hospital expenses, including room rents and ambulance fees are covered.

• OPD treatment cover is available.

• The Policy has a new India baby care that covers any expenses incurred in connection with the delivery of any such newborn baby from birth until the expiry of this Policy.

• Infertility treatment is also covered, subjected to a limit of Rs 1, 00,000 for plan A and Rs 2, 00,000 for Plan B.

• It also covers treatment for STDs, or any condition caused due to human T cell lymphocytic virus type III. The limits are Rs 2, 00,000 for Plan A and Rs 5, 00,000 for Plan B.

• This premium paid under this Policy is eligible for tax savings under Section 80D of the Income Tax Act 1961.

New India Premier Mediclaim Policy has a free 15-days look up period in which the policyholder can go through the policy documents. If he/she finds it unsatisfactory, the same can be returned to the insurer.

The insurer can also cancel the Policy on the grounds of fraud and misrepresentation of personal or medical facts by the policyholder by giving prior written notice.