Reliance Life Increasing Income Plan was an insurance-cum-investment plan offered by Reliance Life Insurance Company, which is now known as Reliance Nippon Life Insurance Company Limited. This plan was designed to provide a combination of life insurance coverage, savings, and regular income to policyholders.

Financial Security: The plan provided life insurance coverage to ensure financial security for your family in the event of your untimely demise, helping them maintain their standard of living and meet their financial needs.

Steady Income Stream: The plan offered an increasing monthly income to the policyholder over the policy term. The monthly income would typically increase by a certain percentage.

Financial Protection: On maturity of the policy or in the unfortunate event of the death of the policyholder during the policy term, a lump-sum amount, which could be the sum assured.

Enhanced Returns: The plan participated in the profits of the company and was eligible for bonuses, which were declared annually and added to the policy, enhancing the overall returns and benefits for the policyholder.

Customizable Plan: Policyholders had the flexibility to choose the premium payment term and policy term based on their financial goals, risk appetite, and investment horizon, allowing them to customize the plan.

Liquidity: After the policy acquired a surrender value, policyholders had the flexibility to make partial withdrawals from the accumulated fund value or avail of a loan against the policy to meet financial needs.

Tax Efficiency: Premiums paid towards the plan were eligible for tax benefits under Section 80C of the Income Tax Act, 1961, helping to reduce taxable income and save on taxes.

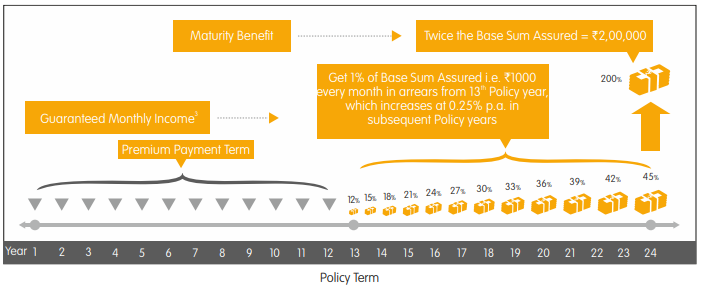

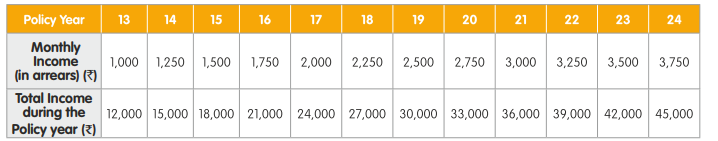

Example 1

Sanjeev, a healthy individual, aged 30 years, opts for Reliance Nippon Life Increasing Income Insurance Plan and,

• Selects the option of Income with Maturity Benefit,Policy Term of 24 years and Base Sum Assured of `1,00,000

• Pays an annual premium of `22,966 p.a. (exclusive of taxes)

• Enjoys increasing Guaranteed Monthly Income which starts at the end of the Premium

Payment Term payable monthly in arrears, till maturity

• Receives a Guaranteed Sum Assured on Maturity equal to twice (two times) the Base Sum

Assured at end of the Policy Term

Scenario I: If Sanjeev, i.e. the Life Assured, survives till maturity

Guaranteed Monthly Income (payable monthly in arrears) is expressed annually for illustrative purposes.

Guaranteed Monthly Income (GMI)

Maturity Benefit: On survival at the end of the Policy Term Sanjeev will receive Guaranteed Sum Assured on Maturity which is equal to twice the Base Sum Assured, i.e. `2,00,000.

Scenario II: In case of Sanjeev’s unfortunate demise in the sixth Policy year, his nominee receives a lump sum benefit of `2,52,626 and the Policy will be terminated.

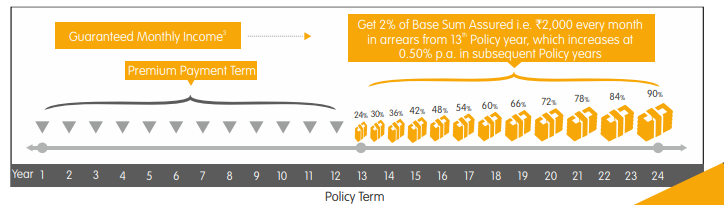

Example 2

Kamal, a healthy individual, aged 30 years, opts for Reliance Nippon Life Increasing Income Insurance Plan and:

Selects Only Income Option, Policy Term of 24 years and Base Sum Assured of `1,00,000

Pays an annual premium of `31,728 p.a. (exclusive of taxes)

Enjoys increasing Guaranteed Income which starts at the end of the Premium Payment Term till maturity

Scenario I:

If Kamal, i.e. the Life Assured, survives till maturity

Scenario II:

In case of Kamal’s unfortunate demise in the sixth Policy year, his nominee receives a lump sum benefit of `3,49,008 and the Policy gets terminated.

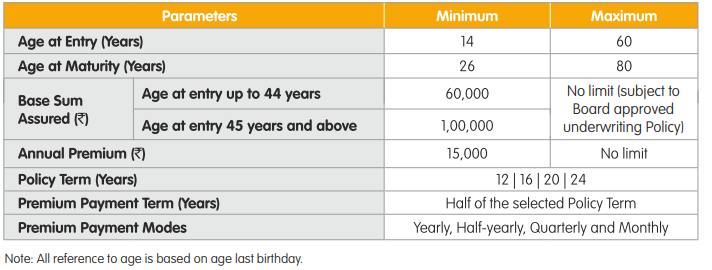

Reliance Nippon Life Increasing Income Insurance Plan at a glance