The Reliance Life Guaranteed Money Back Plan is a life insurance policy designed to provide financial security and guaranteed returns to policyholders. It offers regular payouts at specified intervals during the policy term, ensuring liquidity and meeting financial goals. In addition to the survival benefits, the plan also provides a lump sum payout in case of the policyholder's unfortunate demise during the policy term.

One of the primary attractions of this plan is that it offers guaranteed returns. Policyholders receive a certain percentage of the sum assured at regular intervals during the policy term.

In addition to providing guaranteed returns, the plan also offers life insurance coverage. In the event of the policyholder's demise during the policy term, the sum assured is paid out to the nominee.

The plan offers money-back benefits at regular intervals during the policy term, which can be helpful in meeting various financial needs such as education expenses, marriage expenses, etc.

Like other life insurance policies, premiums paid towards the Reliance Life Guaranteed Money Back Plan are eligible for tax benefits under Section 80C of the Income Tax Act.

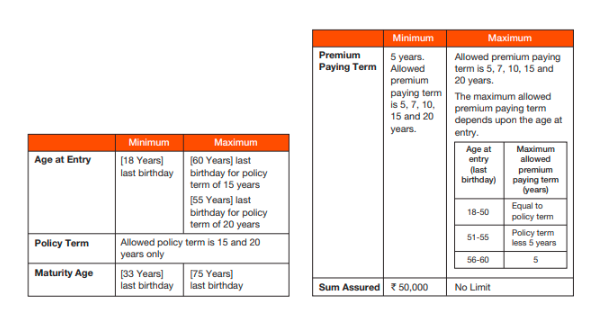

The plan typically offers flexibility in premium payment options, allowing policyholders to choose a premium payment term.

It serves the dual purpose of providing savings as well as protection. Policyholders can build a corpus over time while ensuring financial security for their loved ones.

Depending on the specific plan variant, policyholders may have the option to enhance coverage by adding riders such as accidental death benefit rider, critical illness rider, etc.

Reliance Life Guaranteed Money Back Plan is designed to be easy to understand, making it accessible to a wide range of individuals seeking life insurance with guaranteed returns.

| Description | Minimum | Maximum |

|---|---|---|

| Age at entry | 18 years | 58 years |

| Minimum Premium | - | |

| Max Premium | Multiples of 10000 | |

| Premium Paying Term |

10 years 7 years 5 years |

|

| Policy Term | 15 years | |

| Death Benefit | 10times of Annual Base premium | |

At the end of the policy term irrespective of survival of the life assured provided the policy is not paid up, the total of following two benefits will be paid 1. Accrued Guaranteed Loyalty Additions and 2. Guaranteed Maturity Additions. The policy terminates on payment of maturity benefit.

The following optional riders are available during the premium paying term only, on payment of additional premium over and above the base premium provided conditions on riders (entry age, policy term, sum assured) are satisfied. These rider benefits can be selected on commencement of the policy or on any policy anniversary during a policy term.

Provides lump sum amount to cover surgical expenses from a list of 33 surgeries including Open Heart surgery, Kidney Transplant, Cornea transplantation, Transplant of Lungs and many more.

Provides lump sum amount to take care of 25 critical conditions including Cancer, Heart Attack, Paralysis, Major Organ transplant and many more.

Provides additional death benefit depending on the sum assured selected under the rider.

In the event of death or total and permanent disablement of the life assured, this rider provides a monthly benefit of 1% of sum assured every month (i.e.12% per annum), to the beneficiary. The benefit is payable from the date of death till end of the rider policy term or 10 years whichever is later, before the maturity of the policy.