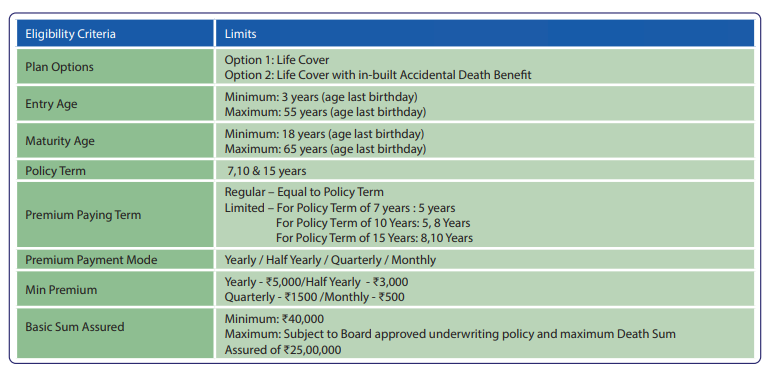

The Shriram Assured Savings Plan offered by Shriram Life Insurance Company Limited allows policyholders to pay regular premiums for a defined period, accumulating savings over time with guaranteed additions. This plan provides life insurance coverage throughout the policy term, offering a maturity benefit comprising the sum assured, accrued bonuses, and fund value upon survival till the end of the term.

The plan provides guaranteed additions at regular intervals during the policy term, ensuring steady growth of savings over time.

Along with savings, the plan offers life insurance coverage, providing financial security to the policyholder's family in the event of the policyholder's demise during the policy term.

Upon survival till the end of the policy term, the policyholder receives the maturity benefit, which includes the sum assured, accrued bonuses, and fund value.

The plan offers flexibility in premium payment options and may allow policyholders to choose the premium payment term and frequency.

Policyholders have the option to enhance their coverage by adding riders such as accidental death benefit rider, critical illness rider, etc., for an additional premium.

Premiums paid towards the plan are eligible for tax benefits under Section 80C of the Income Tax Act, and the proceeds received from the policy.

With its focus on savings accumulation, life insurance coverage, flexibility, and tax benefits, the Shriram Assured Savings Plan offers a comprehensive solution for individuals looking to secure their financial future while meeting their protection needs.

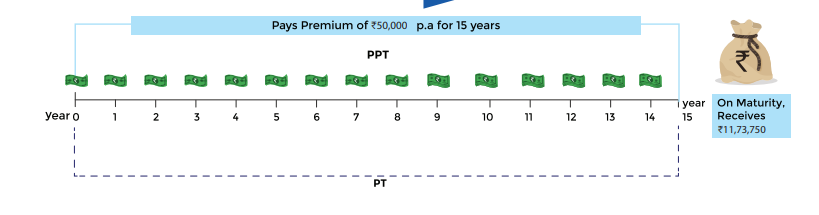

On survival to maturity, Ravi will receive 11,73,750 in lump sum as a Maturity Benefit after paying total premiums of 7,50,000.

How did we arrive at this value?

Basic Sum Assured (BSA) = Premium Payment Term X Annualized Premium

= 15 X 50,000

= 7,50,000

Guaranteed Maturity Sum Assured = BSA X (Maturity Benefit Factor + Higher Premium Additions) %

= 7,50,000 X (141% + 15.5%)

= 7,50,000 X 156.5%

= 11,73,750

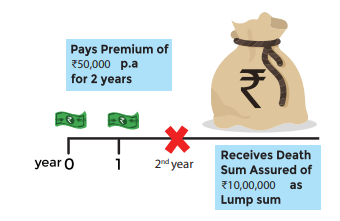

Ravi meets with an accident in the second policy year and passes away. His family receives 10,00,000 in lump sum as Death Benefit.

If Ravi dies due to other reasons other than accident, his family receives a Death Sum Assured of 5,00,000

How did we arrive at this value?

Since Ravi’s age at entry is below 45 years, his Death Benefit will be 10 times the Annualized Premium. As Ravi dies due to an accident, he receives 2 times the Death Sum Assured.

Death Benefit = 2 X 10 X 50,000 ‘ = 10,00,000