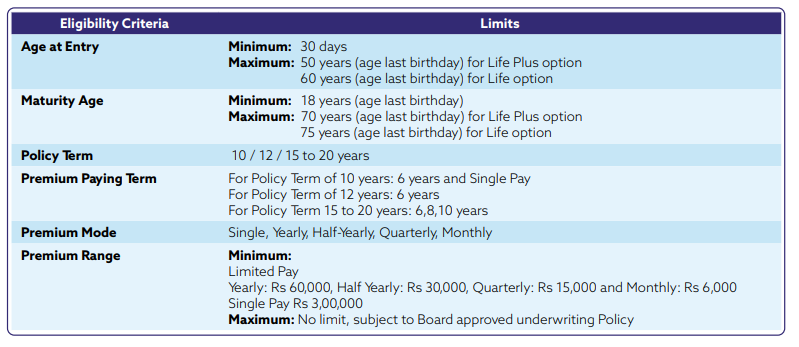

The Shriram Premier Assured Benefit Plan is a life insurance policy offered by Shriram Life Insurance Company Limited, providing a combination of savings and protection. Policyholders pay regular premiums for a specified term, accumulating savings over time with guaranteed additions. The plan offers life insurance coverage throughout the policy term, ensuring financial security for the family. Upon maturity or in the event of the policyholder's demise, the plan provides the assured benefit, comprising the sum assured, accrued bonuses, and guaranteed additions.

It provides a blend of savings accumulation and life insurance coverage, catering to both financial growth and protection needs.

The plan offers guaranteed additions at regular intervals during the policy term, ensuring steady growth of savings over time.

Policyholders are assured of life insurance coverage throughout the policy term, providing financial security to their loved ones in case of unfortunate events.

Upon maturity or in the event of the policyholder's demise, the plan provides the assured benefit, comprising the sum assured, accrued bonuses, and guaranteed additions, ensuring a significant financial payout.

The plan may offer flexibility in premium payment options and may allow policyholders to choose the premium payment term and frequency according to their financial capabilities.

Policyholders have the option to enhance their coverage by adding optional riders such as accidental death benefit rider, critical illness rider, etc., for an additional premium, tailoring the plan.

Premiums paid towards the plan are eligible for tax benefits under Section 80C of the Income Tax Act, providing additional savings.

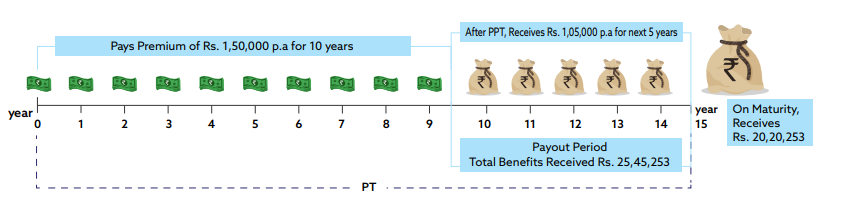

Example:1

Rahul, aged 30 years, wants to save money with Shriram Life Premier Assured Benefit, he opts for the Income option with a Policy Term of 15 years, Premium Payment Term of 10 years, and he pays an Annual Premium of 1, 50,000 + taxes.

The following illustration explains the 2 possible scenarios that can occur provided the policy is in force:-

If Rahul survives till the end of the Policy Term (Maturity)

Rahul will receive the income from the end of the Premium payment term till the last policy year Plus Guaranteed Maturity Benefit is paid in lump sum as below. The total benefits he will receive over these 15 years will be 25, 45,253

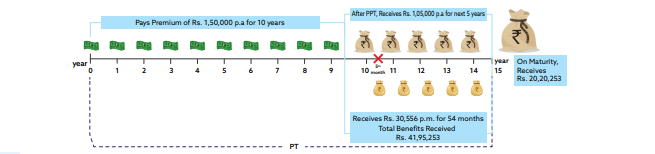

In case of Rahul’s death anytime during the Policy Term, his nominee(s)/beneficiary (ies) will get the Death Benefit* in monthly installments along with the remaining income pay-outs and maturity benefit as scheduled.

If Rahul dies after the premium payment term (Death during the Policy Term)

Rahul has paid all the premiums + Taxes and dies after 10 years 5 months, his nominee(s)/beneficiary (ies) will get Death Benefit* in monthly installments along with the scheduled income pay-outs and maturity benefit in a lump sum. Total benefits received will be 41,95,253.

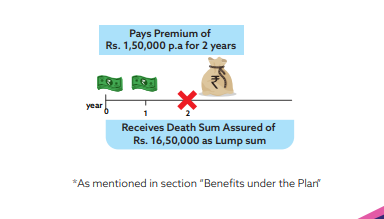

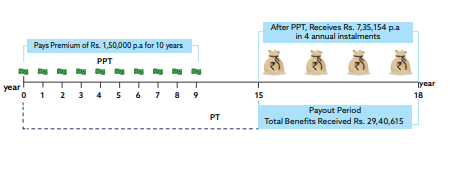

Example: 2

Akhil, aged 30 years, wants to save money with Shriram Life Premier Assured Benefit, he opts for a settlement option with a Policy Term of 15 years, Premium Payment Term of 10 years, and he pays an Annual Premium of 1,50,000 + taxes.

The following illustration explains the 2 possible scenarios that can occur provided the policy is in force:-

If Akhil survives till the end of the Policy Term (Maturity)

Akhil will receive Guaranteed Maturity Benefit in 4 annual installments as below.

The total benefits he will receive will be 29,40,615 In case of Akhil’s death anytime during the Policy Term, his nominee(s)/beneficiary (ies) will get the Death Benefit* and the policy terminates

If Akhil dies during the 3rd policy year (Death during the Policy Term)

Akhil has paid 2 Annual Premiums + Taxes and dies during the 3rd policy year, his nominee(s)/beneficiary (ies) will get a Death Benefit* of 16,50,000 and the policy terminates.