At various stages of life, you may have diverse goals, whether it's purchasing your first car, financing your child's education, or planning for a comfortable retirement. While the list of goals can be extensive, it's essential to identify and plan for them financially. Therefore, opting for a flexible savings life insurance plan becomes crucial. Such a plan not only aids in achieving your financial objectives but also ensures your family's financial stability in your absence. To assist you in this journey, Bandhan Life presents 'Bandhan Life iGuarantee Max Savings'. This insurance plan offers more than just consistent growth of your savings. It helps you reach your milestones and provides protection for your family against unforeseen circumstances.

Helps you to start saving with as little as Rs.500* premium per month while being insured

Guaranteed amount on maturity or on surrender to help you secure your short, medium and long term life goals

Option to choose premium payment term at the frequency you choose as per your convenience.

Enhance your plan with riders for Accidental Death and Critical Illness.

Avail tax benefits, as per applicable laws as amended from time to time.

You can customize your policy to suit your requirement with these few steps:

This plan is best suited for those who want to channel their money in a safe environment without any risk of market volatility and look for guaranteed returns. They are willing to remain invested for longer duration to plan for their life goals like international vacations, child’s education, or corpus for a peaceful retirement

| Description | Minimum | Maximum |

|---|---|---|

| Age at entry | 18 years | 50 years |

| Minimum Premium | 10,000 + GST | |

| Max Premium | Multiples of 10000 | |

| Premium Paying Term | 10 years | |

| Policy Term | 10 years/15 years | |

| Death Benefit | 11-12 times of Annual Base premium | |

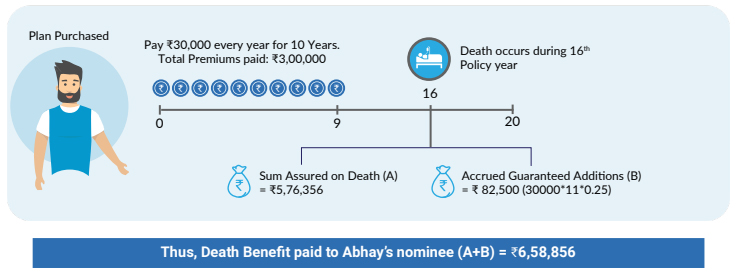

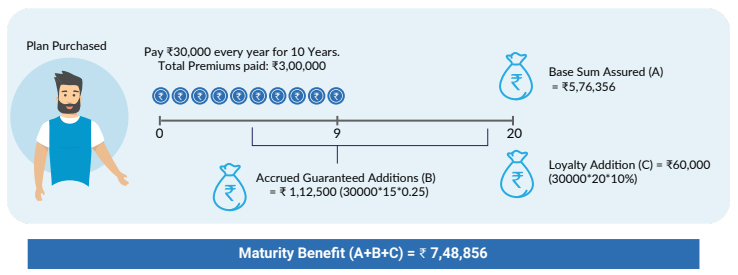

Abhay, aged 35 years, has a 1 year old child for whom he wants to create a corpus that can help pay for educational expenses during college years. He opts for Bandhan Life iGuarantee Max Savings, customized as follows

Policy Term: 20 years | Premium Payment Term: 10 years (limited pay) | Annual Premium: ?30000 per annum | Death Benefit Multiple chosen: 11 | Base Sum Assured: ?5,76,356

Scenario 1 : Abhay receives the maturity benefit, whilst enjoying life cover for the entire coverage period of 20 years

Scenario 2 : In case of Abhay’s death at the start of the 16th Policy year, the death benefit will be payable to his nominee/ claimant, subject to all due premiums under the policy being paid.