Bandhan Life Saral Jeevan Bima is a straightforward and affordable life insurance plan designed to provide financial security to individuals and their families. With its simplified features and competitive premiums, this plan aims to offer hassle-free protection against life's uncertainties.

Bandhan Life Saral Jeevan Bima offers a straightforward and easy-to-understand plan structure, eliminating any confusion and making it easier for you to select the coverage that best aligns with your financial goals and requirements.

With competitive and affordable premiums, Bandhan Life Saral Jeevan Bima ensures that quality life insurance protection is accessible to individuals from diverse financial backgrounds, allowing you to secure your family's future without straining your budget.

The plan provides you with the flexibility to choose a policy term that suits your needs, enabling you to align the insurance coverage with your financial goals and the duration for which you require protection.

Bandhan Life Saral Jeevan Bima offers comprehensive protection against life's uncertainties, ensuring that your loved ones are financially secure and supported in your absence. The plan's death benefit provides a lump sum payout to the nominee, helping them meet various financial obligations, including daily expenses, children's education, outstanding loans, and other liabilities.

For enhanced coverage and protection, Bandhan Life Saral Jeevan Bima offers the option to add an Accidental Death Benefit (ADB) rider. This rider provides an additional sum assured in the event of death due to an accident, ensuring that your family receives comprehensive and adequate financial support during unforeseen circumstances.

Investing in Bandhan Life Saral Jeevan Bima offers you the advantage of tax benefits. The premiums paid towards the plan are eligible for tax deduction under Section 80C of the Income Tax Act, 1961. Additionally, the death benefits received by the nominee are tax-exempt under Section 10(10D), subject to prevailing tax laws, making it a tax-efficient investment option.

By opting for Bandhan Life Saral Jeevan Bima, you can enjoy peace of mind knowing that your family's financial future is secure and protected against life's uncertainties.

Understanding how a life insurance plan works is essential to make an informed decision. Here's a detailed explanation of how Bandhan Life Saral Jeevan Bima operates:

Policy Commencement:

Premium Payment:

Accrual of Benefits:

Death Benefit:

Accidental Death Benefit (ADB) Rider:

Maturity Benefit:

Paid-Up Status:

Waiting Period:

| Description | Minimum | Maximum |

|---|---|---|

| Age at entry | 18 years | 65 years |

| Maximum Maturity Age | 70 years | |

| Policy Term | Minimum - 5 years | Maximum - 40 years | |

| Sum Assured | Minimum - 5,00,000 | Maximum - 25,00,000 Sum Assured would be offered in multiple of 50,000 only | |

| Premium Payment Option | Regular Pay - Equal to Policy Term Limited Pay - 5 Pay & 10 Pay | |

| Criteria |

Education: 10th Pass Proof: Pan No is must Income - Salaried & Self Employed-1.25 Lks (Proof not required) Video MER (Based on health condition) |

|

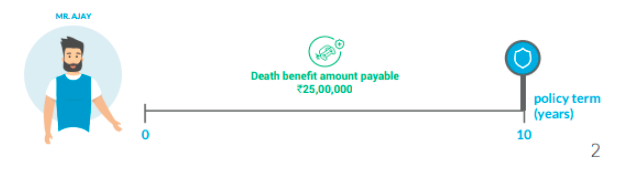

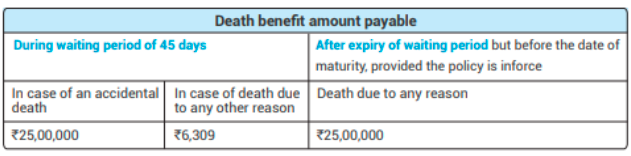

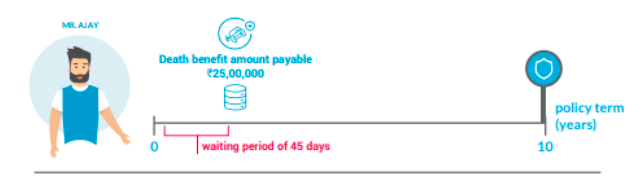

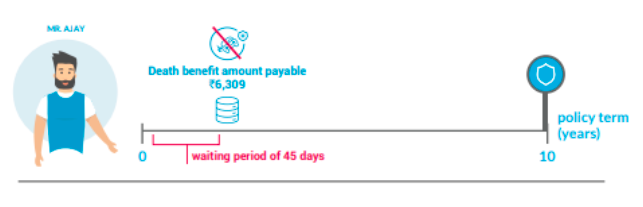

Mr. Ajay is a 30 year old male who opts for Bandhan Life Saral Jeevan Bima Insurance Plan and following are the details about his policy. Sum Assured - ` 25,00,000 | Policy Term - 10 years | Premium Payment Term - Regular Pay | Yearly premium - ` 6,309

In case of an accidental death During waiting period of 45 days

In case of death due to any other reason During waiting period of 45 days

In case of death due to any reason After expiry of waiting period but before the date of maturity, provided the policy is inforce