Bandhan Life iTerm Comfort is a leading term insurance plan meticulously designed to offer robust financial protection and security to policyholders and their families.

iTerm Comfort provides a high level of coverage at affordable premiums. It offers financial protection to your family in the event of your untimely demise during the policy term.

The plan offers flexibility in choosing the policy term, premium payment term, and coverage amount based on your financial needs and future goals.

The entire process of buying and managing the policy is online, which makes it convenient and hassle-free. You can easily purchase the policy, pay premiums, and make changes to your policy details through the company's online portal.

Premiums paid towards Bandhan Life iTerm Comfort are eligible for tax benefits under Section 80C of the Income Tax Act, 1961. Additionally, the death benefit received by the nominee is tax-free under Section 10(10D) of the Income Tax Act.

Bandhan Life has a good claim settlement ratio, which indicates the company's efficiency in settling claims. A high claim settlement ratio gives policyholders confidence that their claims will be settled promptly in the unfortunate event of a claim.

With Bandhan Life iTerm Comfort, you can ensure financial security for your loved ones by providing them with a lump sum amount or monthly income, as chosen by you, to meet their living expenses, pay off debts, or achieve long-term financial goals.

Bandhan Life is known for its transparent terms and conditions, ensuring that policyholders fully understand the coverage, benefits, exclusions, and terms of the policy before making a purchase.

Choice of Coverage Amount and Policy Term:

Death Benefit:

Maturity Benefit:

Online Management:

Tax Benefits:

| Description | Minimum | Maximum |

|---|---|---|

| Age at entry | 18 years | 65 years |

| Maximum Maturity Age | Minimum - 23 years | Maximum - 70 years | |

| Policy Term | Minimum - 5 years | Maximum - 70 years(Less entry Age) | |

| Premium Paying Term | Same as Policy Term | |

| Premium Payment Option | Regular Pay | |

| Sum Assured |

Minimum - 25 Lakhs | Maximum - 1.25 Cr |

|

| Criteria |

Education: 12th Pass Proof : Pan No is must Income Criteria - If Salaried - 2.5 Lks Criteria If Self Employed - 3 Lks Below 50 Lakhs Sum Insured - No Medicals required Above 50 Lakhs - Video MER & Medicals will be called |

|

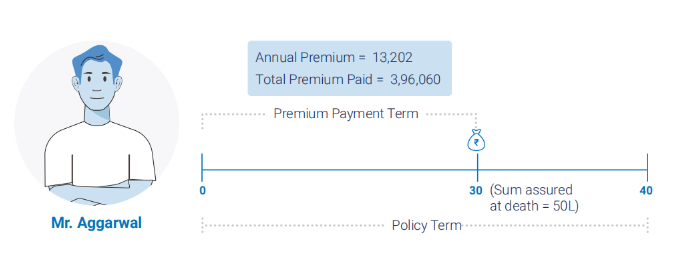

Mr. Aggarwal (Age 30 years, Non-smoker) opts for Bandhan Life iTerm Comfort. His policy details are as follows:

In case of Mr. Aggarwal’s death at the age of 60 years, an immediate lump-sum payout of 50 lakh will be payable to the Claimant, subject to all due premiums under the Policy being paid.

The below example is for a standard, healthy life. The policy will terminate post payment of death and no further benefits will be payable.

In case of death of the life assured for an in-force policy (all due premiums have been paid), the death benefit

(as applicable on the date of death) is payable as a lump sum to the Claimant.

Death Benefit is defined as the Highest of:

• 11 x Annualized Premium(1) or

• 105% x all Policy Premiums paid (excluding taxes) as on the Date of Death or

• Sum Assured

Annualized Premium shall be the premium amount payable in a year chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums and

loadings for modal premiums, if any.

The Policy will terminate on payment of the above benefit.