At Global Finsol, we believe that everyone deserves access to quality healthcare without financial strain. That's why we're proud to introduce the Arogya Sanjeevani Policy, a comprehensive health insurance solution designed to provide you and your family with affordable and reliable coverage for your medical needs.

Our Commitment

With the Arogya Sanjeevani Policy, our commitment is to ensure that you have access to the healthcare services you need, when you need them, without worrying about the cost. We understand the importance of staying healthy and want to make quality healthcare accessible to all, regardless of their financial situation.

The Arogya Sanjeevani Policy offers comprehensive coverage for a wide range of medical expenses, including hospitalization, surgeries, diagnostic tests, consultations, and more. You can rest assured that you and your family.

We believe that healthcare should be affordable for everyone. That's why we offer competitive premiums for our Arogya Sanjeevani Policy, making it accessible to individuals and families of all income levels.

Whether you're an individual looking for coverage or a family seeking protection for your loved ones, we offer flexible policy options to suit your specific needs and budget. Choose the coverage amount.

Our network of healthcare providers allows you to avail cashless treatment at hospitals and clinics across the country. Simply present your Arogya Sanjeevani Policy card at the time of admission, and we'll take care of the rest.

Key Features

Hospitalization Cover:

Pre and Post-Hospitalization Expenses:

Day Care Procedures:

Ambulance Charges:

Get in Touch

Secure your family's health with the Arogya Sanjeevani Policy by Global Finsol. Contact us today to learn more about our policy options and find the right coverage for your healthcare needs. With our commitment to affordable premiums, comprehensive coverage, and dedicated customer service, you can trust us to be your partner in health and wellness.

Arogya Sanjeevani Policy, a basic health insurance policy which provides coverage for medical / hospitalization expenses up to Rs. 5 lakhs. The Insurance Regulatory and Development Authority of India (IRDAI) has mandated all health insurers to come up with the basic & standard health insurance policy for both individuals & families.Aarogya Sanjeevani Health Policy are universal for all general & health insurance companies in India with the several benefits. It covers pre & post hospitalization expenses which includes bed charges, nursing charges, ICU & doctor consultation charges and many more. Arogya Sanjeevani Health Insurance protects you & your family from the financial burden in case of any medical emergencies.

There are two types of plans comes under the Arogya Sanjeevani Insurance Policy:

• Individual Plan: Under this plan only 1 policyholder is the beneficiary.

• Family Floater Plan: In this plan entire family members can avail the benefits of Arogya Sanjeevani Policy. The policyholder can include dependents, such as spouse, children, parents & parents-in-law in a single policy.

There are several features that differentiate an Arogya Sanjeevani Policy from other health insurance plans available in India. Take a look at some of the most attractive features of Arogya Sanjeevani Policy below:

• More economical than other health plans

• Universal coverage, terms & conditions across all health insurance companies in India

• Sum insured ranging from Rs. 1 lakh to Rs. 5 lakhs

• Available in Individual as well as Family Floater basis

• Covers hospitalization expenses related to COVID-19 (Coronavirus)

Arogya Sanjeevani Policy has been launched with an aim to simplify health insurance in India by offering a basic & standard medical insurance with the exact same coverage by all best health insurance companies. It strives to provide basic indemnity insurance benefits to the policyholder across all income groups in India. To understand this policy better, take a look through the list of benefits that a policyholder can avail under the Arogya Sanjeevani Plan:

• No More Confusion - It eliminates the scope of any confusion that may arise in the minds of a policyholder as the same level of coverage and the terms & conditions is offered by all insurance companies in India.

• Lower Co-payment Option - It offers a lower co-payment option of only 5% of the total claim amount, which means the applicant will have to pay the only 5% of the total claim amount at the time of settlement.

• Cumulative Bonus - Just like other medical insurance policies, the Arogya Sanjeevani Health Plan also rewards a cumulative bonus of 5% on the total sum insured amount for every claim-free year.

• Boon for First-Time Buyers - This is the perfect stepping & an ideal choice for a first-time health insurance buyer as he will be able to get a wide range of coverage at minimum cost without the hassles of understanding the pros and cons of different kinds of health plans.

• Lifetime Renewability - It comes with lifetime renewability that allows policyholders to renew their policies for as long as they live.

• Arogya Sanjeevani Health Insurance Policy can be availed by any person between the age of 18 years to 65 years. Under the Arogya Sanheevani Family Floater Plan, you can purchase this policy for dependent children between 3 months & 25 years.

• If your children age is above 18 years then he / she can’t be covered under the family floater health scheme. You need to buy Arogya Sanjeevani Individual Health Plan for the same.

• Under the Family Floater Arogya Sanjeevani Health Policy, a policyholder can include his / her parents & parents-in-law. This policy comes with lifelong renewability.

All policyholders of the Arogya Sanjeevani Policy offer a 15-day free-look period. This means the policyholder can cancel his / her policy within the first 15 days without paying any cancellation charges. The paid premium will be refunded to the policyholder minus any expenses incurred by the insurance company, provided no claims were made during this period.

Please note that the free-look period is not applicable at the time insurance renewals.

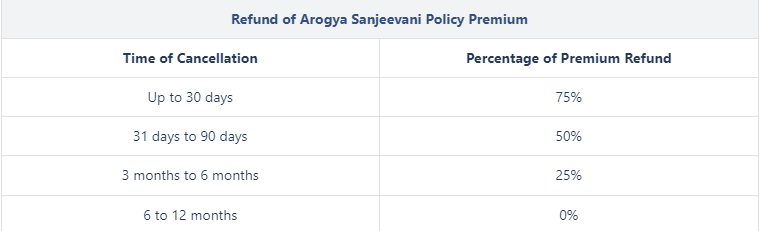

However, if the 15-day free-look period gets over, the policyholder can still cancel his Arogya Sanjeevani Health Insurance Policy. He will be required to give a 15-days written notice to the insurance provider for cancelling the policy. The premium for the remaining policy period will be refunded to the policyholder as per the rates given below: