Star Health Insurance understands the importance of protecting your family's health and well-being. That's why we're proud to introduce our Family Health Optima Insurance Plan, designed to provide comprehensive coverage and peace of mind for you and your loved ones.

Our Family Health Optima Insurance Plan offers extensive coverage for medical expenses related to hospitalization, surgeries, treatments, diagnostic tests, medications, and more. With a wide range of benefits, you can ensure that your family receives the care.

Enjoy the convenience of cashless treatment at our vast network of hospitals and healthcare providers across the country. With our network hospitals, you can receive quality healthcare services without worrying about upfront payments or reimbursement hassles.

Our family floater option allows you to cover your entire family under a single policy, making it convenient and cost-effective. With one policy, you can protect your spouse, children, and dependent parents or in-laws, ensuring comprehensive coverage for your entire family.

We reward you for maintaining a healthy lifestyle and avoiding claims with our no claim bonus feature. With every claim-free year, you can enjoy an increase in your sum insured at no additional cost, providing added protection for your family's future healthcare needs.

In the unfortunate event of a medical emergency, we understand the importance of prompt claim settlement. Our dedicated claims team works tirelessly to ensure that your claims are processed quickly and efficiently.

Key Features of Family Health Optima Insurance Plan

Protect Your Family's Health Today

Don't compromise when it comes to your family's health and well-being. With the Family Health Optima Insurance Plan from Star Health Insurance, you can enjoy comprehensive coverage, cashless treatment, and peace of mind knowing that your loved ones are protected. Contact us today to learn more about our policy features, coverage options, and premium rates. Our dedicated insurance experts are here to help you find the right coverage that fits your family's healthcare needs and budget.

Experience the difference with Family Health Optima Insurance Plan from Star Health Insurance. Protect your family's health and secure their future today.

A Super Saver Policy

Single Sum Insured

Extra Benefits å Coverage for entire family

Considerable saving in premium as the family is covered under single sum insured

Eligibility

Any person aged between 18 years and 65 years, residing in India, can take this insurance

Beyond 65 years, It can be renewed for life time

Child above 16 days of age can be covered as part of the family. If, at the commencement of the policy, the new born child is less than 16 days of age, the proposer can opt to cover such child also in the same policy by paying the applicable premium in full. However, the cover for such child will commence only from the 16th day after its birth and continue till the expiry date of the policy

Family: Self, Spouse / Live in partner / Same Sex partner, dependent children from 16 days up to 25 years (Dependent children means children who are economically dependent on their parents), Dependent Parent / Parent in law also covered

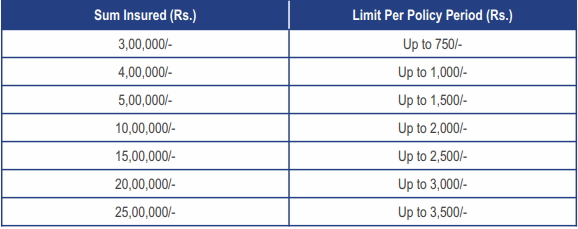

Sum Insured Options: Rs.3,00,000/-, Rs.4,00,000/-, Rs.5,00,000/-, Rs.10,00,000/-, Rs.15,00,000/-, Rs.20,00,000/- and Rs.25,00,000/-

Installment Facility available: Premium can be paid Half-yearly or Quarterly, Premium can also be paid Annually and Biennially. (once in 2 years). For installment mode of payment, there will be loading as given below:

Quarterly - 3% | Half Yearly - 2%(will be applicable on the annual premium)

Note: If Installment Facility is opted for 2 year term policies, the full premium applicable for 2 year terms should be paid in quarterly or half yearly within the expiry of the first year.

Policy term: One year / Two year - For policies more than one year, the Basic Sum Insured is for each year, without any carry over benefit thereof

Long term discount: If the policy term opted is 2 years, discount available is at 10% on 2nd year premium. ò Upfront Discount: We will provide an upfront discount of 5% on the premium, if the questions related to lifestyle and habits are answered by the insured at the time of purchasing this policy.

Note ·

This discount will be available only on the base policy premium not on Optional/ Add-on covers.

This discount will be available only once, that is at the time of first purchase of this policy and if purchased online.

The discount will be given only if all the Adult Members proposed for Insurance answered the questions.