At Star Health Insurance, we understand that your health and well-being are priceless. That's why we're excited to introduce Star Extra Protect, an add-on cover designed to provide additional protection and peace of mind for you and your loved ones.

Star Extra Protect offers enhanced coverage beyond your existing health insurance policy. It provides additional benefits and features to further safeguard your health and financial security, giving you comprehensive protection against unforeseen medical expenses.

Star Extra Protect offers personalized healthcare coverage tailored to individual needs, covering critical illnesses and personal accidents.

Medical emergencies can arise unexpectedly, leading to significant financial strain. Star Extra Protect ensures that you're financially prepared for any eventuality by offering additional coverage for medical treatments, hospitalization expenses, surgeries, and more.

With Star Extra Protect, you can enjoy peace of mind knowing that you and your loved ones have comprehensive protection against unexpected healthcare costs. Whether it's covering the cost of a critical illness treatment or providing financial support in the event of a personal accident, Star Extra Protect has you covered.

Key Features of Star Extra Protect

Protect Yourself and Your Loved Ones Today

Don't wait until it's too late to protect your health and financial security. Invest in Star Extra Protect today and enjoy added peace of mind knowing that you have comprehensive coverage for unexpected medical expenses. Contact us now to learn more about our add-on cover options, customization features, and premium rates. Our dedicated insurance experts are here to help you find the right coverage that fits your needs and budget.

Experience the difference with Star Extra Protect from Star Health Insurance. Secure your health and financial future today with our comprehensive add-on cover.

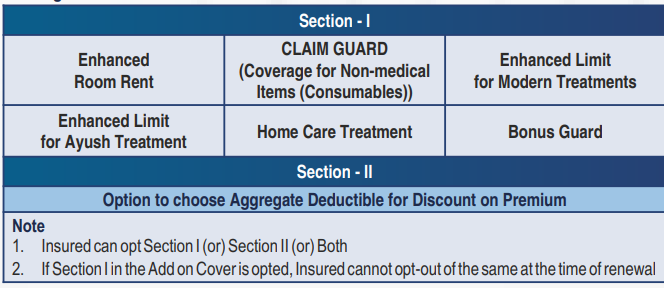

It is always said - a little extra makes all the difference. We do believe in the same and hence we are happy to present “Star Extra Protect – Add on Cover” which enhances the limits of existing covers in addition to offering new features to the Base Policy

Eligibility

Note: During renewal, if Insured reduces the Base Policy Sum Insured to below Rs.10,00,000/-, the Add on Cover will not be available

Base Policy – Family Health Optima Insurance Plan / Star Comprehensive Insurance Policy / Medi Classic Insurance Policy (Individual)

Age/Family Size Applicability – As per Base Policy

Add on Cover Term – As per Base Policy

Premium for (Section - I) – 15% on the applicable Base Policy premium