Star Health Insurance is committed to providing comprehensive and specialized healthcare solutions to meet the unique needs of our customers. With that commitment in mind, we are proud to introduce Special Care Gold, a specialized health insurance policy designed to offer extensive coverage and personalized care for individuals with specific health concerns.

Special Care Gold is tailored to provide coverage for individuals with specific health conditions or medical needs, ensuring that you receive the specialized care and treatment.

Our policy offers a wide range of benefits, including coverage for hospitalization expenses, medical treatments, surgeries, diagnostic tests, medications, and more.

We understand that each individual's healthcare needs are unique.That's why Special Care Gold offers personalized care and support, including access to specialized.

With rising healthcare costs, unexpected medical expenses can quickly add up. Special Care Gold provides financial protection and peace of mind, helping you manage healthcare expenses and focus on your recovery without worrying about the financial burden.

Our dedicated customer support team is available to assist you with any questions or concerns you may have regarding your policy, claims process, coverage details, or healthcare needs. We are committed to ensuring that you receive the support and assistance.

Key Features of Special Care Gold

Get Specialized Care Today

Don't let healthcare concerns hold you back. With Special Care Gold from Star Health Insurance, you can enjoy comprehensive coverage, personalized care, and peace of mind knowing that your healthcare needs are taken care of. Contact us today to learn more about our policy features, coverage options, and premium rates. Our dedicated insurance experts are here to help you find the right coverage that fits your unique healthcare needs and budget.

Experience the difference with Special Care Gold from Star Health Insurance. Get the specialized care and support you deserve and enjoy a healthier, happier life.

Policy Term: 1 Year

Type of Policy: Individual

Entry Age

For Adults – Minimum - 18 years & Maximum - Up to 65 years

For Dependent Children – Newborn to 17 years ™ Sum Insured Options:Rs.4,00,000/- and Rs. 5,00,000/-

Pre-Policy Medical check-up: There are no pre medical tests irrespective of age. The previous medical records include details of treatment to be submitted along with the proposal.

Installment Facility available: Premium can be paid Quarterly or Half-yearly. Premium can also be paid Annually. For installment mode of payment, there will be loading as given below:

Quarterly: 3%

Half Yearly: 2%

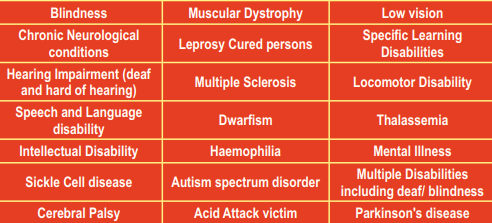

Eligibility for Coverage Disability Cover

Covering Persons with Disability as per The Rights of Persons with Disabilities Act, 2016. The cover under this policy is available for persons with the following disability/disabilities as defined under the Act and any subsequent additions / modifications to the list in the Act.

It is Condition Precedent that this cover can be availed only on mandatory submission of Disability certificate issued by the Certifying authority.

Disability for the purpose of this policy means a person with 40% or more of a specified disability as per the Act, where, specified disability has not been defined in measurable terms and includes an Insured Person with disability where specified disability has been defined in measurable terms, as Certified by the Certifying authority