Max Life Monthly Income Advantage Plan is a unique insurance plan offered by Max Life Insurance Company designed to provide a combination of life insurance protection and regular monthly income to policyholders. This plan is particularly suitable for individuals looking for a steady income stream to meet their regular expenses and financial commitments.

The plan offers a guaranteed monthly income to the policyholder's family in case of the policyholder's demise during the policy term. This ensures that the family's financial needs are met on a regular basis, providing stability and support.

In the unfortunate event of the policyholder's death, the plan provides a lump sum amount as the death benefit to the nominee or beneficiary. This amount can help cover immediate expenses, outstanding debts, or provide long-term financial support to the family.

Policyholders have the flexibility to choose from various income payout options, such as increasing monthly income, level monthly income, or a combination of both, based on their financial goals and requirements.

The plan offers flexibility in premium payment options, allowing policyholders to choose between regular premium payment or limited premium payment terms according to their convenience and affordability.

If the policyholder survives the entire policy term, they receive a maturity benefit, which may include a lump sum payout or periodic payments, providing financial security for future needs or retirement planning.

Policyholders can enhance their coverage by adding optional riders or additional benefits to the base plan, such as accidental death benefit, critical illness benefit, or waiver of premium benefit, providing comprehensive protection against various risks.

Choose the Policy Term:

The policyholder selects the duration of the policy, known as the policy term, based on their financial goals and requirements. This term determines how long the policy will remain in force.

Select the Premium Payment Term:

The policyholder decides on the premium payment term, which can be regular or limited. During this term, the policyholder pays premiums to keep the policy active.

Choose the Sum Assured:

The policyholder selects the sum assured, which is the amount of coverage or benefit payable in case of the policyholder's demise during the policy term. This sum assured can be chosen based on the policyholder's financial obligations and needs.

Receive Guaranteed Monthly Income:

Throughout the policy term, the policyholder receives guaranteed monthly income payments from the insurance company. The amount of monthly income is predetermined and specified in the policy documents. This income provides financial stability and support to the policyholder and their family.

Additional Benefits:

Depending on the plan's features and options chosen, the policyholder may receive additional benefits such as maturity benefits, death benefits, or optional riders for enhanced coverage against specific risks like critical illnesses or accidental death.

Survival Benefits:

If the policyholder survives the entire policy term, they may receive a maturity benefit, which could be in the form of a lump sum payout or periodic payments, providing financial security for future needs or retirement.

Claim Process:

In the event of the policyholder's demise during the policy term, the nominee or beneficiary needs to file a claim with the insurance company. Upon successful verification of the claim documents, the insurer pays out the death benefit to the nominee/beneficiary.

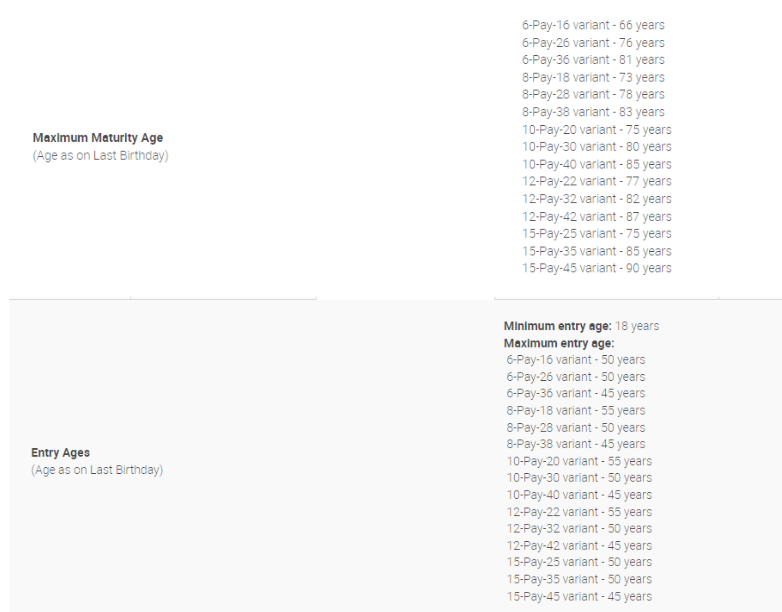

| Description | Minimum | Maximum |

|---|---|---|

| Age at entry | 18 Years | 55 years |

| Premium |

52,250 |

No Limit |

| Premium Payment Term | 6/8/10 years | |

| Income Period | 16/ 18/20 years | |

| Policy Term | 10 years | |

| Death Benefit | 11 times of Annualized Base Premium | |

| Inbuilt Rider |

Policy Continuance Benefit (PCB) |

|

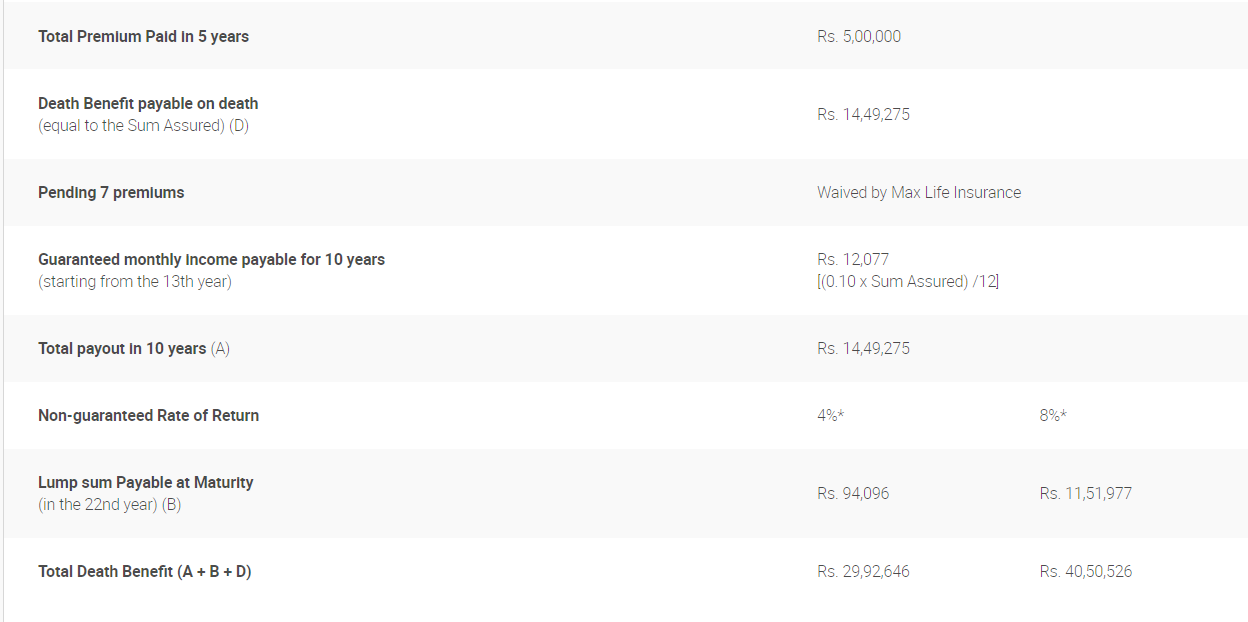

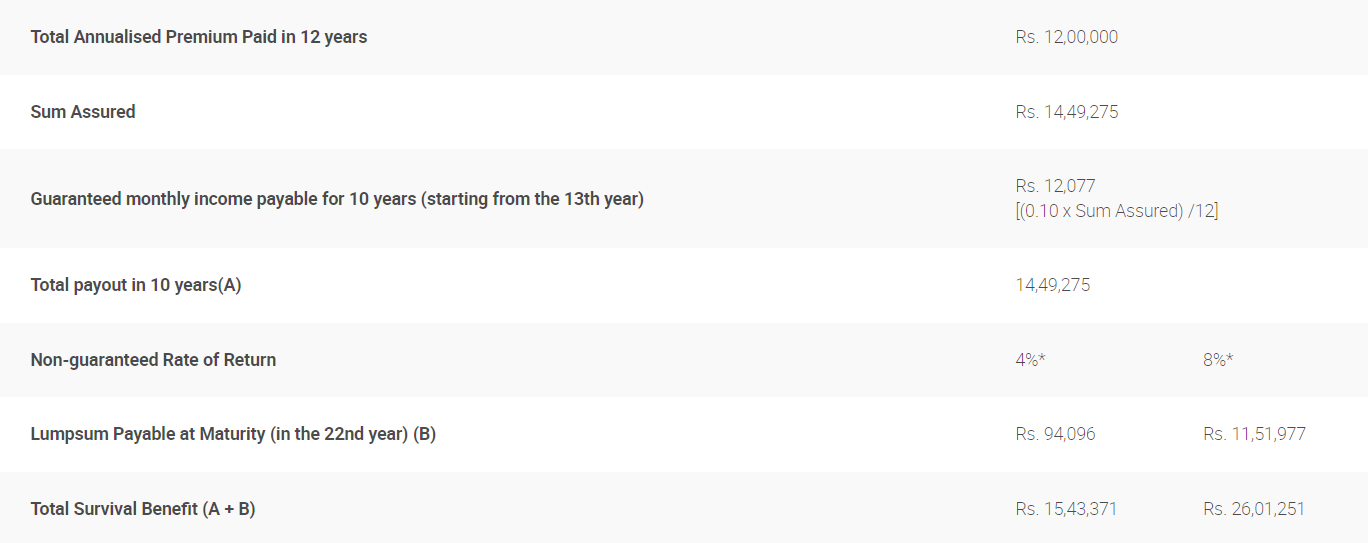

Mr Bajaj, aged 40 years, invests Rs. 1,00,000 in Max Life Monthly Income Advantage Plan on an annual basis. He opts for a 12-year Premium Payment Term (22-year Policy Term). Let’s see how this plan would work for him

Mr Bajaj survives through the Policy Term.

Mr Bajaj meets with an accident and dies in the 5th policy year, i.e. after paying 5 Premiums.