Max Life Smart Wealth Advantage Guaranteed Plan is an insurance-cum-investment plan offered by Max Life Insurance Company. This plan is designed to provide both protection and savings benefits to policyholders.

Life Insurance Coverage: The plan provides life insurance coverage to ensure financial security for your family in case of your unfortunate demise, their standard of living.

The plan offers guaranteed additions to boost the fund value, which are a percentage of the annualized premium added to the policy at the end of every policy year. This feature enhances the overall returns.

Premium Payment Term: Policyholders can choose the premium payment term based on their financial goals, ranging from a single premium to regular premiums for a limited period or until a certain age.

The plan offers flexibility in choosing the policy term, allowing you to align the plan with your financial goals and investment horizon, whether it's short-term or long-term.

To reward long-term policyholders, the plan offers loyalty additions, which are additional units added to the policy at regular intervals. the fund value and boosts.

The plan allows policyholders to make partial withdrawals from the accumulated fund value after a certain period, to meet financial needs such as funding emergencies.

Policyholders have the flexibility to switch between different fund options based on market conditions, investment preferences, and risk appetite without any charges your investment strategy.

Premiums paid towards the plan are eligible for tax benefits under Section 80C of the Income Tax Act, 1961, helping you save on taxes and reduce your taxable income.

Maturity proceeds and death benefits.

The plan is managed by professional fund managers who have expertise in managing investments across different asset classes and market conditions, ensuring optimal returns and risk management for your investment.

The plan comes with transparent charges and costs, with no hidden fees, allowing you to understand the cost structure and make an informed decision based on your financial goals and investment objectives.

Choice of Policy Term and Premium Payment Term:

• Policy Term: Policyholders can choose the policy term based on their financial goals and investment horizon, ranging from 10 to 30 years.

• Premium Payment Term: The plan offers flexibility in choosing the premium payment term, allowing policyholders to opt for single, limited, or regular premiums based on their financial situation and preferences.

Payment of Premiums:

• Policyholders need to pay regular premiums for the chosen premium payment term to keep the policy active and benefit from life insurance coverage and investment growth.

• Premiums can be paid monthly, quarterly, half-yearly, or annually as per the convenience of the policyholder.

Investment of Premiums:

• The premiums paid by the policyholder are invested in various fund options offered by Max Life Insurance Company, such as equity funds, debt funds, and balanced funds.

• Policyholders can choose to allocate their premiums among different fund options based on their risk appetite, investment objectives, and market outlook.

Accumulation of Fund Value:

• Over time, the premiums paid, along with guaranteed additions, loyalty additions, and potential investment returns, accumulate to form the fund value.

• The fund value represents the total value of the investments made under the policy and grows over time through capital appreciation and reinvestment of dividends and bonuses.

Guaranteed Additions:

• The plan offers guaranteed additions to boost the fund value, which are a percentage of the annualized premium added to the policy at the end of every policy year.

• These guaranteed additions enhance the overall returns and accelerate the growth of the investment, providing an additional layer of security and assurance to the policyholder.

Loyalty Additions:

• To reward long-term policyholders, the plan offers loyalty additions, which are additional units added to the policy at regular intervals.

• These loyalty additions further enhance the fund value and boost the overall returns on the investment, providing an incentive for policyholders to stay invested for the long term.

Partial Withdrawals:

• The plan allows policyholders to make partial withdrawals from the accumulated fund value after completing a certain period, usually after 5 years from the commencement of the policy.

• Policyholders can utilize these partial withdrawals to meet financial needs such as funding emergencies, paying for children's education, or financing major expenses without surrendering the policy.

Switching Option:

• Policyholders have the flexibility to switch between different fund options based on market conditions, investment preferences, and risk appetite without any charges.

This feature allows policyholders to optimize their investment strategy, diversify their portfolio, and maximize returns by capitalizing on market opportunities.

Maturity or Death Benefit:

• On maturity of the policy or in the event of the unfortunate death of the policyholder during the policy term, the accumulated fund value or the death benefit (whichever is higher) is paid to the policyholder or the nominee.

• The maturity or death benefit provides financial security and support to the policyholder or their family, helping them maintain their standard of living and meet their financial needs.

The Max Life SWAG Plan is a comprehensive solution that provides investors with the dual benefit of wealth creation along with financial protection in terms of life cover for your loved ones. One key feature of Smart Wealth Advantage Guarantee Plan is that this policy provides assured returns designed to ensure continuous growth of your savings and investments irrespective of changing market conditions. Moreover, you get the option to choose from different variants of the SWAG Plan that are customized to meet a wide range of financial requirements.

Survival benefits of this policy are applicable if the life insured policyholder outlives the policy term. Survival benefits available with various variants of the Max Life Smart Wealth Advantage Guarantee Plan include income benefit, money back benefit and/or loyalty income booster. Details of survival benefits for different variants of the policy are:

No survival benefit is applicable under this variant.

With this variant, the survival benefits available include income benefit along with loyalty income booster. This booster amount is 10% of the income benefit offered.

With this variant, the survival benefits available include income benefit along with loyalty income booster. This booster amount is 10% of the income benefit offered.

Plan: This variant of the SWAG plan also features a combination of loyalty income booster along with income benefit. The booster amount is 20% of the income benefit offered. Along with return of premium at maturity.

Plan: This policy variant offers only income benefit starting 1st, 5th, 7th or 10th year on survival to the policyholder and, a lumpsum benefit payable at maturity.

Plan: This variant of the Max Life SWAG Plan provides income benefit, money back benefit as well as income booster benefit to the policyholder. The income booster benefit offered with this policy variant is 20% of the income benefit. The money back benefit of the policy is equal to 50% of the sum assured on maturity and is payable after the policyholder is 85 years or older.

All variants of the Smart Wealth Advantage Guarantee Plan from Max Life Insurance offer life cover and death benefits in the case the policyholder’s demisewhile the policy is in effect. However, the death benefit of these policies differ depending on whether or not the policyholder has opted for the policy continuance benefit (PCB).

1. On Opting for PCB: In this case, the death benefit available is equal to the higher amount among the sum assured or 125% of the surrender value of the policy. If the policyholder has not opted for the single premium payment option, the higher among 3 amounts will be payable as death benefit – sum assured on death, 125% of the surrender value or 105% of total premiums paid plus underwriting extra premium plus loading for modal premiums.

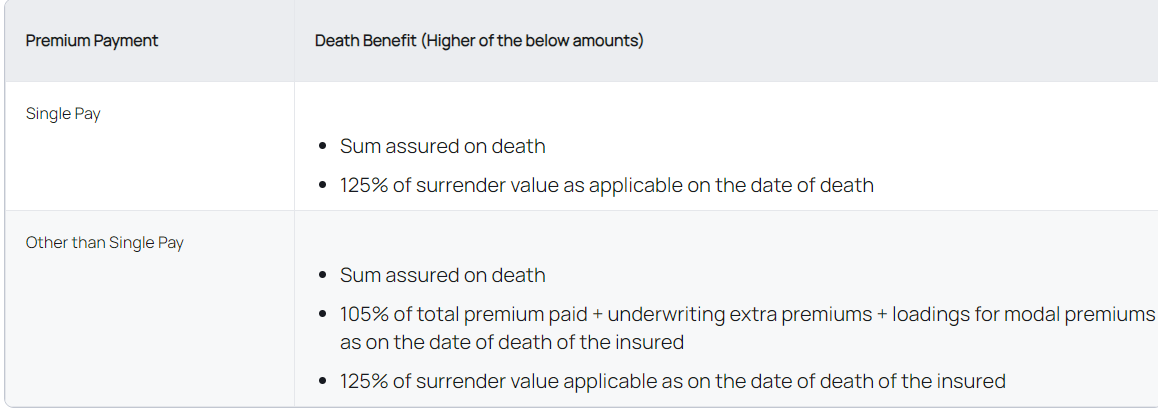

2. If PCB is not Opted: In this case, the death benefit will be as follows: