The Max Life Secure Earnings & Wellness Advantage Plan is an insurance product offered by Max Life Insurance Company. It is designed to provide financial protection to policyholders and their families in case of unforeseen events such as death, disability, or critical illness, while also offering wellness benefits to promote a healthy lifestyle. The plan typically combines features of term insurance, income protection, and health insurance, providing a comprehensive solution to meet the diverse needs of individuals and their families.

The plan provides comprehensive financial protection against life's uncertainties, including death, disability, and critical illness. Policyholders can have peace of mind knowing that they and their loved ones are financially secure in case of unforeseen events.

The plan offers regular income benefits to policyholders, ensuring a steady stream of income to support their families' financial needs, even in their absence or during a period of disability.

In addition to financial protection, the plan includes wellness benefits aimed at promoting a healthy lifestyle. Policyholders can avail themselves of health check-ups, discounts on health services, and rewards for adopting healthy habits, contributing to their overall well-being.

The plan offers flexibility in terms of coverage options, premium payment terms, and payout options. Policyholders can customize their coverage according to their individual needs and preferences, ensuring that the plan aligns with their financial goals.

Max Life Insurance Company is a reputable insurer known for its reliability, customer service, policyholder satisfaction. Choosing the Max Life Secure Earnings & Wellness Advantage Plan allows individuals to benefit from the company's expertise and reputation in the insurance industry.

Policy Purchase:

• Individuals interested in the plan can purchase it from Max Life Insurance by choosing the coverage amount, premium payment term, and other options according to their needs.

Premium Payment:

• Policyholders need to pay regular premiums as per the chosen premium payment term to keep the policy in force.

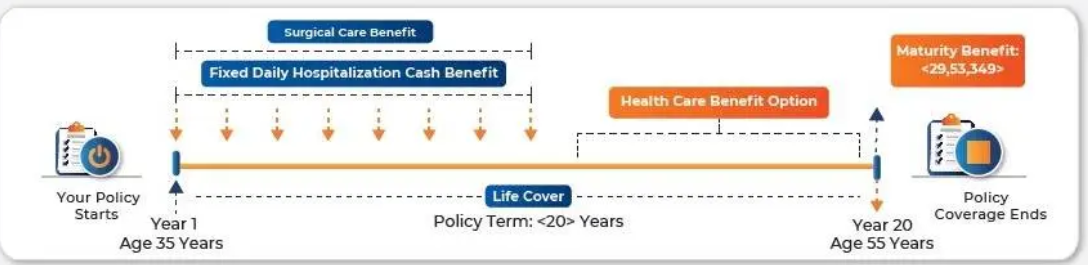

• overage Period: The plan provides coverage for a specified period, typically ranging from a few years to several decades, depending on the policyholder's preferences.

Financial Protection:

• In the event of the policyholder's death during the coverage period, the plan provides a death benefit to the nominee/beneficiary, which can help replace lost income and meet financial obligations.

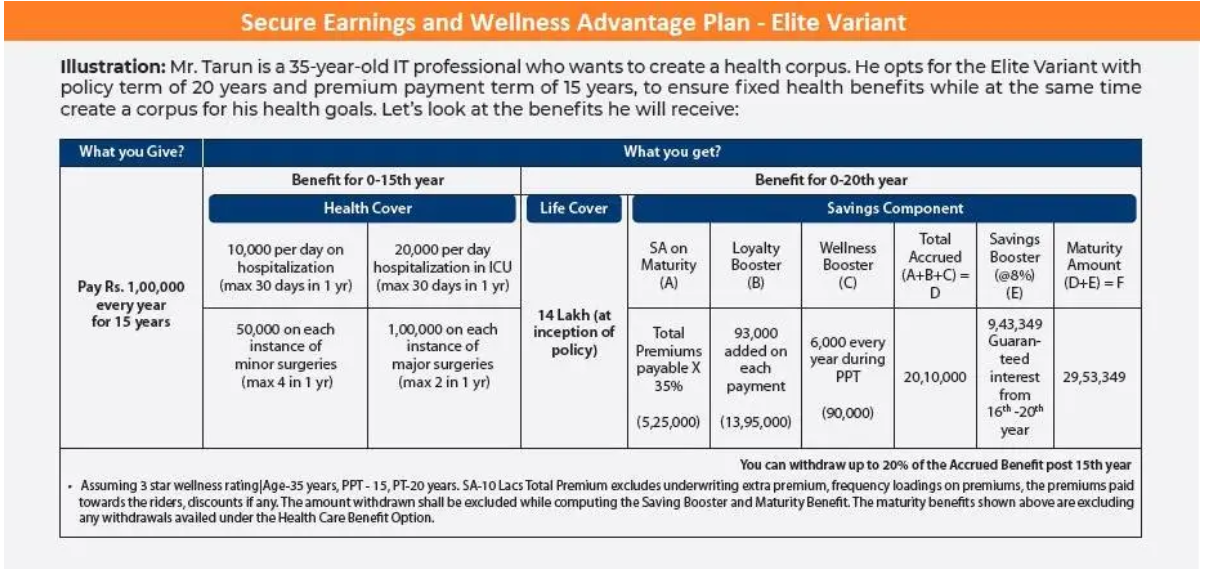

• Regular Income: If the policyholder survives the policy term, the plan offers regular income benefits, ensuring a steady stream of income for the policyholder or their family.'

Wellness Benefits:

• Throughout the policy term, policyholders can avail themselves of various wellness benefits, such as health check-ups, discounts on health services, and rewards for maintaining a healthy lifestyle.

• Optional Riders: Policyholders may have the option to enhance their coverage by adding riders or additional benefits to the base plan, providing extra protection against specific risks.

Maturity Benefit:

• Upon reaching the end of the policy term, if the policyholder survives, they may be eligible to receive a maturity benefit, which can include a lump sum payout or periodic payments, depending on the plan's features.

| Description | Minimum | Maximum |

|---|---|---|

| Age at entry | 18 years | 55 years |

|

Premium Payment Term |

10 years |

No Limit |

| Policy Term | 15 years | |

| Maximum Maturity Age | 70 Years | |

| Sum Assured | 3 to 10 Lakhs | |

| Death Benefit | 12 times of Annual Base Premium (varies as per age) | |

| During Premium Paying Term | Fixed Hospitalization Benefit & Fixed Surgical Benefit | |

| Post Premium Paying Term | Health Care Benefit (from 10th year to 15th Year) | |

| Added Riders |

Critical Illness & Disability Rider |

|

1. Max Life Accidental Death and Dismemberment Rider

This rider provides additional benefits in case of death or dismemberment of the Life Insured due to an accident.

2. Max Life Term Plus Rider

If chosen, this rider provides additional lump sum benefit in case of death of the Life Insured.

3. Max Life Critical Illness and Disability Rider

This rider provides an additional lump sum benefit in case the life insured is diagnosed with a critical illness.