The Max Life Smart Secure Plus Plan is a comprehensive life insurance policy offered by Max Life Insurance. It provides financial protection to policyholders and their families in case of death during the policy term, with the option to choose additional riders for enhanced coverage. The plan also offers maturity benefits if the policyholder survives the entire term, along with tax benefits on premiums paid and benefits received, subject to prevailing tax laws.

The plan provides comprehensive coverage against the financial uncertainties of life, offering a lump sum benefit to the nominee in the event of the policyholder's demise during the policy term.

Policyholders have the flexibility to choose the policy term and coverage amount based on their financial goals, budget, and protection needs. This allows for customization to suit individual requirements.

The plan offers optional riders such as accidental death benefit, critical illness benefit, and disability benefit, allowing policyholders to enhance their coverage and tailor it to their specific needs.

If the policyholder survives the entire policy term, they receive a maturity benefit, which is paid out as a lump sum amount. This can be used to meet future financial needs.

Max Life Insurance Company is one of the leading life insurance providers in India, known for its strong financial stability, and efficient claims settlement process.

Policy Purchase:

You start by purchasing the plan from Max Life Insurance. You choose the coverage amount, policy term, and any optional riders you want to add to enhance your coverage.

Payment of Premiums:

You pay regular premiums for the duration of the policy term. Premium payments can typically be made annually, semi-annually, quarterly, or monthly, depending on the policy terms.

Coverage Period:

During the coverage period, if the policyholder passes away, the designated nominee receives the death benefit, which is the sum assured chosen at the time of policy purchase. This benefit provides financial security to the family or dependents of the policyholder in the event of their untimely demise.

Optional Riders:

If you opt for additional riders like accidental death benefit, critical illness benefit, or disability benefit, you may receive extra coverage in case of specific events outlined in the rider.

Maturity Benefit:

If the policyholder survives the entire policy term, they receive the maturity benefit, which is a lump sum amount paid out at the end of the policy term. This amount can be used for various purposes, such as retirement planning or meeting financial goals.

Policy Surrender or Lapse:

Depending on the terms of the policy, you may have the option to surrender the policy before maturity or let it lapse due to non-payment of premiums. However, surrendering or lapsing the policy may result in the loss of benefits and may have financial implications.

| Description | Minimum | Maximum |

| Age At Entry |

18 years | 60/65 years |

| Maturity Age | 10 years | 85 years |

| Policy Term | 10 years | Up to 85 age |

| Premium Payment Term | Limited Pay: 5/10/12/15 years | Regular Pay: Policy Term minus Entry age |

| Sum Assured | 50 Lacs | 20 Crores |

| Educational/Annual Income Criteria |

In case of Graduate: If Salaried – 3.5 lacs If Business – 5.0 lacs |

In case of SSC pass: If Salaried – 10 lacs If Business – 10 lacs |

In-Built Riders

Special Exit Value at the age of 65 years

Terminal Illness Benefit – 50 % of SI is paid immediately and future premiums are waived off.

For Regular Pay – Premium break can be taken at 11th and 22nd year (company will pay on behalf of the customer)

For Special Exit Value at the age of 65 yrs (Entry age should be below 40 yrs)

Having a sound financial plan against unforeseeable circumstances is crucial. You can ensure your family’s well-being in your absence by investing your hard-earned money in the right instrument. Let’s understand how the Max Life Insurance term plan works in detail to help you make a well-informed decision.

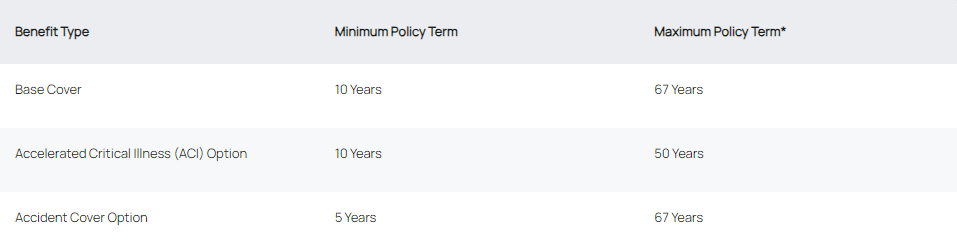

With Max Life Smart Secure Plus Plan, you get to choose from the following benefit types and policy term options while purchasing the policy:

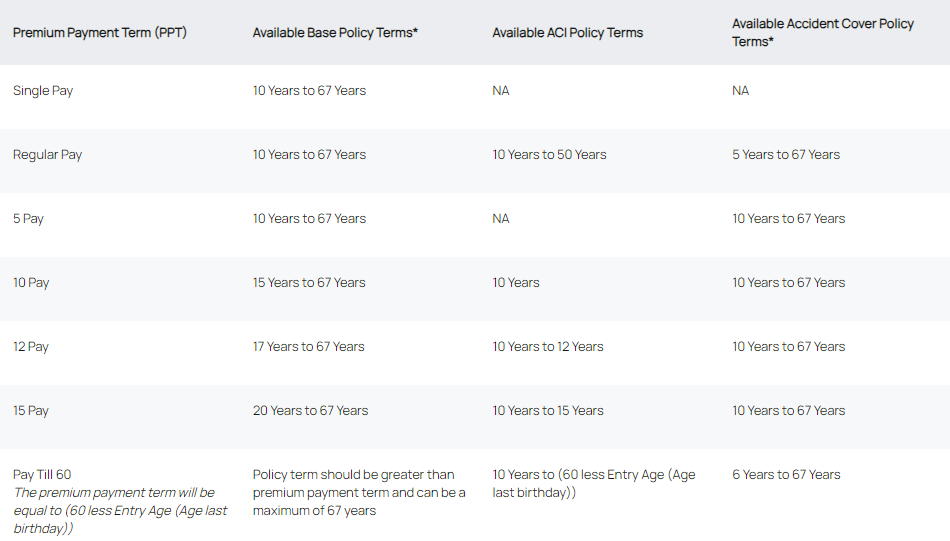

Additionally, there are different premium payment terms available such as:

You can establish a strong financial support system for your loved ones with the Life Cover or Increasing Life Cover option offered by Max Life Smart Secure Plus Plan. This plan allows you to choose from variants and ensure that the sum assured is adequate even for the coming years. With the options for customisation available, you can cover all your bases and keep your family secure and financially stable during challenging times. Since the primary objective of any term plan is to cover the insured individual’s life and financial liabilities, it is crucial to choose the life cover option carefully. Make sure you map your financial requirements for the future well and select the life cover option that aligns with your objectives fittingly.

Suppose you opt for the return of the premium variant with a smart secure plus plan at the time of purchase. In that case, it entitles you to receive a maturity benefit upon surviving the policy term. With this option available, you can receive the total premium paid at the end of the policy term.

• Joint life cover is available only for your spouse i.e. Secondary Life.

• This option is only available at inception

• Joint life cover is available only if the Primary life base sum assured is greater than or equal to Rs. 1 crore.

• Maximum maturity age for Secondary Life shall be 85 years (age last birthday) post which the Secondary Life policy will terminate irrespective of the Primary Life policy still being inforce

• Premium break cannot be opted with this feature

• Features like ACI, ROP, Increasing cover, voluntary top-up & SEV are applicable on PLI cover only